vdrsoftwareonline.com – As of October 18, 2024, several key market trends are emerging, reflecting shifts in investor sentiment, economic indicators, and geopolitical developments. Here’s an overview of the most significant trends shaping the financial landscape today.

1. Stock Market Volatility

Stock markets are currently experiencing heightened volatility due to mixed earnings reports and economic data. Major indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite have shown fluctuations in early trading. Investors are reacting to a mix of positive and negative corporate earnings. While some tech giants report robust growth, concerns over inflation and rising interest rates continue to weigh on market sentiment.

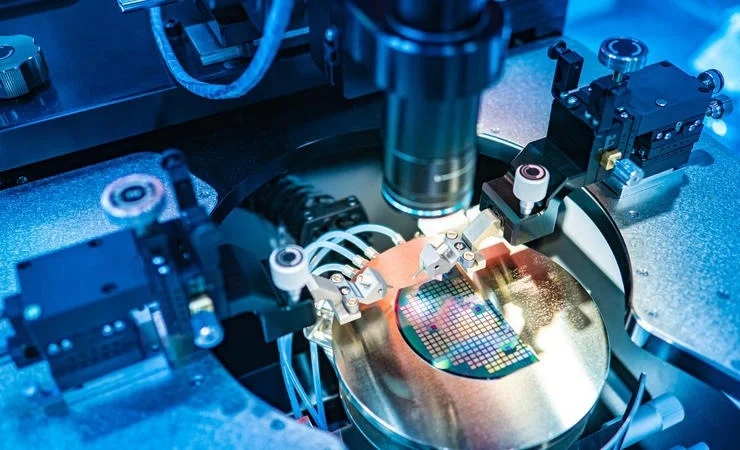

2. Tech Sector Resilience

The technology sector remains a focal point for investors, with companies innovating and adapting to changing consumer demands. Despite mixed earnings reports, major players in cloud computing, AI, and cybersecurity are showing resilience. Investors are particularly interested in firms providing solutions for remote work and digital transformation, which continue to gain momentum in the post-pandemic world.

3. Energy Market Shifts

The energy sector is witnessing significant fluctuations, driven primarily by geopolitical tensions and supply chain disruptions. Crude oil prices have surged due to ongoing conflicts in key oil-producing regions, leading to reduced supply. This rise in energy prices raises inflation concerns, prompting increased scrutiny of energy stocks. Conversely, renewable energy companies are gaining traction as governments and consumers push for sustainable solutions, making them attractive long-term investment opportunities.

4. Cryptocurrency Market Developments

Cryptocurrency markets are seeing renewed interest and volatility. Bitcoin and Ethereum prices have surged as institutional investors regain confidence in digital assets. Regulatory clarity in various countries is fostering a more stable environment for cryptocurrencies, attracting both retail and institutional investors. However, analysts caution that potential corrections may occur, emphasizing the need for cautious investment due to inherent volatility.

5. Consumer Sentiment and Spending Trends

Recent consumer sentiment surveys indicate a mixed outlook. While spending remains relatively strong, concerns about inflation and rising interest rates have made consumers more cautious about discretionary spending. Retail stocks are being closely monitored as companies prepare for the holiday shopping season. Many are focusing on e-commerce strategies to capture online sales, with those effectively navigating supply chain challenges likely to stand out.

6. Global Economic Indicators

Economic indicators released this week present a complex picture. Unemployment rates remain low, but inflation continues to concern central banks. The Federal Reserve’s stance on interest rates will be pivotal in shaping market trends in the coming months. Investors are closely watching for signals from the Fed regarding potential rate hikes, as these decisions will impact borrowing costs and consumer spending.

Conclusion

As October 18, 2024, unfolds, market trends reflect a blend of resilience and caution among investors. The volatility in stock markets, alongside developments in the tech and energy sectors, highlights ongoing adjustments to a rapidly changing economic landscape. Staying informed and adaptable will be crucial for making sound investment decisions in the months ahead.

With geopolitical tensions, evolving consumer behavior, and fluctuating economic indicators, the market landscape remains dynamic, filled with both opportunities and challenges.