vdrsoftwareonline.com – As we delve into the current market trends for today, October 15, 2024, several key indicators and developments are shaping the financial landscape. Investors and analysts are closely monitoring stock performance, economic indicators, and global events that could influence market direction.

Stock Market Overview

Today, the U.S. stock market is experiencing a mix of volatility and cautious optimism. Major indices, including the Dow Jones Industrial Average, S&P 500, and NASDAQ, are showing varied performance as investors react to recent economic data and corporate earnings reports. The market’s direction is influenced by several factors, including inflation rates, interest rate expectations, and geopolitical tensions.

Economic Indicators

Recent economic reports indicate a slight easing in inflation, which has provided some relief to investors. The Consumer Price Index (CPI) showed a modest increase, suggesting that inflationary pressures may be stabilizing. This development has led to speculation about the Federal Reserve’s next moves regarding interest rates. Many analysts believe that if inflation continues to cool, the Fed may adopt a more dovish stance in upcoming meetings, which could positively impact market sentiment.

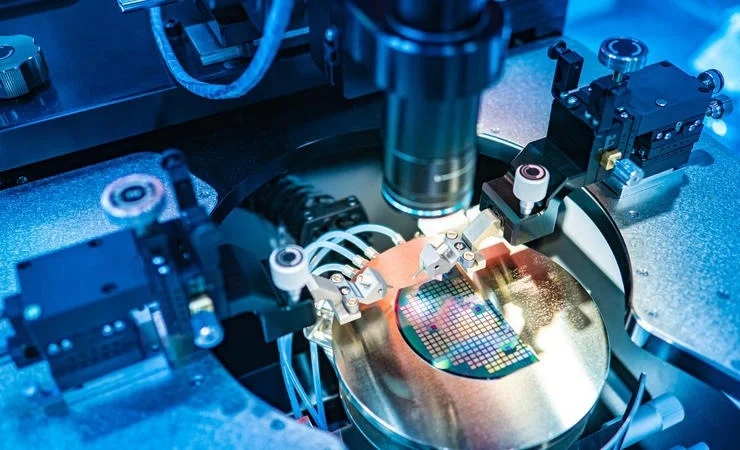

Sector Performance

In terms of sector performance, technology stocks are once again in the spotlight. Companies in the tech sector are benefiting from strong earnings reports and continued demand for digital services. Additionally, renewable energy stocks are gaining traction as governments worldwide push for sustainable energy solutions. Conversely, the financial sector is facing headwinds due to concerns over potential regulatory changes and economic uncertainty.

Global Market Influences

Globally, markets are reacting to various geopolitical events, including trade negotiations and tensions in Eastern Europe. Investors are keeping a close eye on these developments, as they can significantly impact market stability. Furthermore, fluctuations in commodity prices, particularly oil and gold, are also influencing market trends today.

Investor Sentiment

Investor sentiment appears cautiously optimistic, with many looking for opportunities in undervalued stocks. The recent earnings season has provided insights into corporate health, and many companies have exceeded expectations, boosting confidence among investors. However, there remains a level of caution as market participants await further economic data and guidance from the Federal Reserve.

Conclusion

In summary, today’s market trends reflect a complex interplay of economic indicators, sector performance, and global influences. While there are signs of stabilization in inflation and positive corporate earnings, geopolitical tensions and regulatory concerns continue to loom. As always, investors are advised to stay informed and consider these factors when making investment decisions. The coming days will be crucial in determining the market’s trajectory as we move further into the fourth quarter of 2024.