vdrsoftwareonline – As we delve into the current state of the stock market today, several key trends and insights are shaping investor sentiment and market dynamics.

Market Overview

The stock market is experiencing a mix of volatility and cautious optimism. Recent analyses indicate that investors are closely monitoring economic indicators and corporate earnings reports, which are crucial for understanding market direction. The Dow Jones and other major indices are showing fluctuations, reflecting broader economic concerns and investor reactions to recent news .

Investor Sentiment

Investor sentiment appears to be influenced by a combination of factors, including inflation rates, interest rates, and geopolitical events. The current inflation rate stands at 2.4%, with core inflation at 3.3%, indicating a more stable economic environment compared to previous highs. This stability may encourage investors to engage more actively in the market, seeking opportunities in sectors that show resilience and growth potential .

Key Sectors to Watch

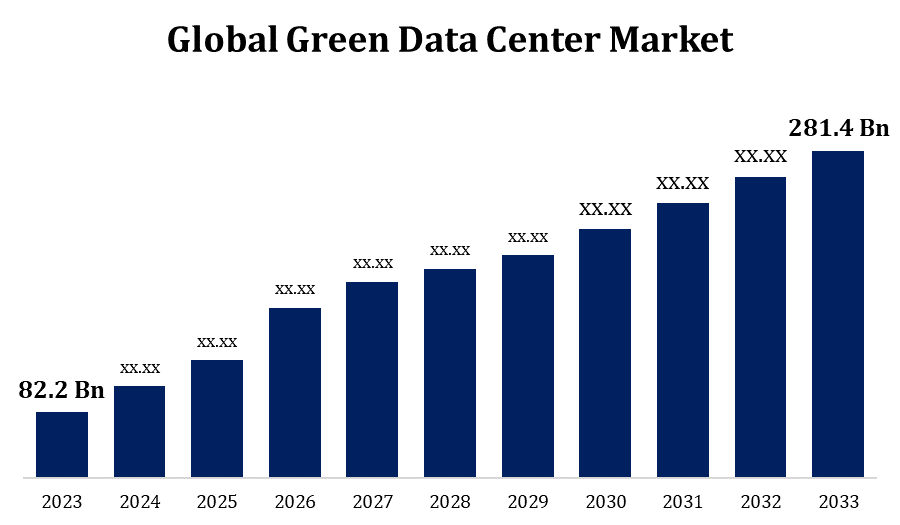

Certain sectors are gaining traction, particularly those related to technology and renewable energy. The ongoing shift towards digital transformation and sustainability is prompting investors to focus on companies that are well-positioned to benefit from these trends. Additionally, sectors such as healthcare and consumer goods are also attracting attention as they demonstrate consistent performance amid market fluctuations .

Technical Indicators

Market analysts are utilizing various psychological indicators and technical analysis tools to gauge potential shifts in market direction. These indicators can provide insights into investor behavior and market momentum, helping traders make informed decisions. Keeping an eye on these signals is essential for navigating the current market landscape effectively .

Conclusion

The stock market today is characterized by a blend of cautious optimism and volatility, driven by economic indicators and sector-specific trends. As investors navigate this complex environment, staying informed about market dynamics and emerging opportunities will be crucial for making strategic investment decisions. The focus on stability in inflation and growth in key sectors suggests that there may be promising avenues for investment in the near future.