vdrsoftwareonline.com – As the new year begins, global markets are gearing up for an eventful January 2025. From economic forecasts to sectoral shifts, a variety of trends are expected to shape the global economic and financial landscape. Here’s a breakdown of the key trends to watch this month:

1. Economic Stability and Growth

Global economies are entering 2025 with cautious optimism. While some regions anticipate steady growth, others face challenges due to geopolitical tensions and inflationary pressures. In major economies like the United States and China, central banks are expected to maintain a balanced approach to monetary policy to sustain growth while keeping inflation under control.

- United States: The U.S. Federal Reserve is likely to hold interest rates steady, aiming to balance economic expansion with inflation targets.

- China: Focus remains on economic recovery through domestic consumption and technological innovation, despite lingering effects of trade tensions.

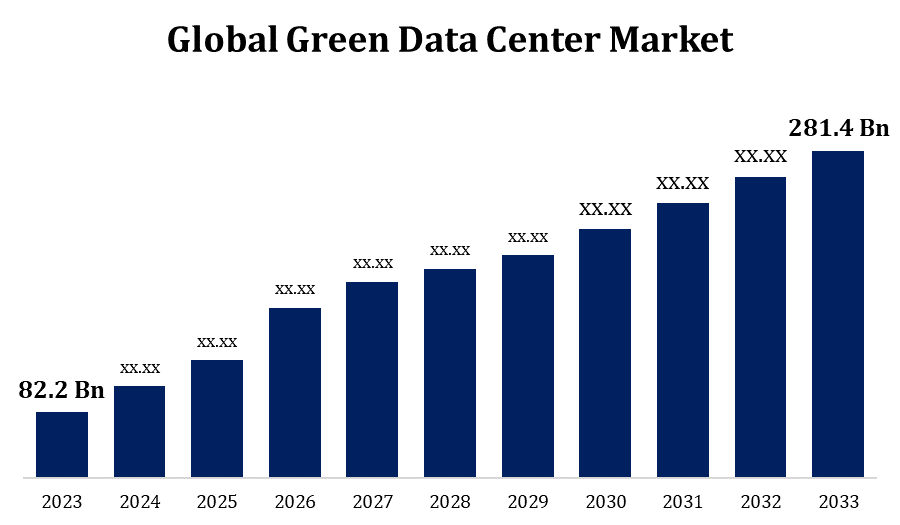

2. Renewed Focus on Sustainability

Sustainability is poised to dominate market dynamics in 2025. Companies and investors are increasingly prioritizing Environmental, Social, and Governance (ESG) criteria, with sectors like renewable energy, sustainable agriculture, and green technologies attracting significant attention. Governments worldwide are implementing stricter regulations and incentives to meet climate goals, further driving investments in this space.

- The European Union’s Green Deal continues to influence industries, particularly energy and transportation.

- Developing nations are also expanding their renewable energy capacity, with solar and wind power leading the charge.

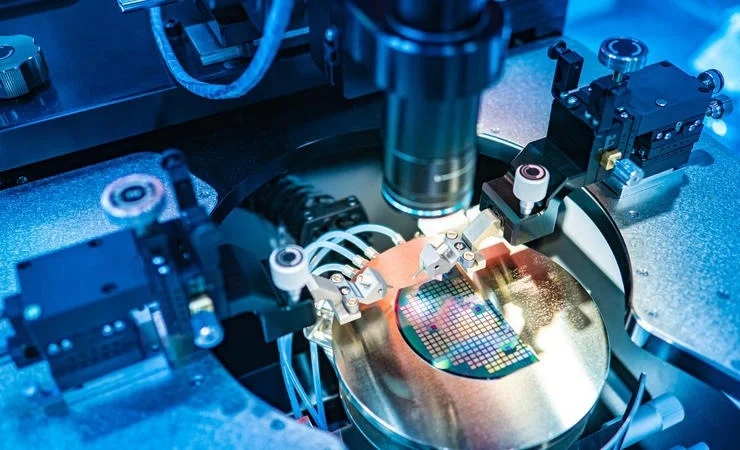

3. Tech Sector: AI and Beyond

The technology sector remains a cornerstone of global markets, with advancements in artificial intelligence (AI), quantum computing, and biotechnology driving innovation. Companies integrating AI into operations and services are expected to gain a competitive edge, while breakthroughs in biotech promise new opportunities in healthcare and pharmaceuticals.

- AI Trends: Increased adoption of generative AI across industries such as finance, retail, and healthcare.

- Biotech Boom: Continued investment in personalized medicine and genetic research.

4. Crypto Resurgence

Cryptocurrency markets are witnessing renewed enthusiasm as Bitcoin and other digital assets show resilience. Bitcoin, which saw substantial gains in 2024, is projected to test new highs in January 2025. Institutional investors are driving much of this momentum, though regulatory uncertainties remain a key challenge.

- Bitcoin’s price is approaching its previous all-time high, creating buzz among traders and investors.

- Central Bank Digital Currencies (CBDCs) are gaining traction as governments explore digital currency frameworks.

5. Stock Market Volatility

While stock markets started the year on a positive note, volatility persists due to global uncertainties. Analysts predict sectoral shifts, with technology and renewable energy stocks expected to outperform, while traditional sectors like manufacturing may experience slower growth.

- Emerging Markets: Increased foreign investment as investors seek higher returns.

- Developed Markets: Stabilization efforts are in focus amid economic and geopolitical uncertainties.

6. Energy Markets in Transition

Energy markets continue to experience a transition from fossil fuels to renewable sources. Oil prices remain stable but could see fluctuations due to geopolitical developments and OPEC policies. Meanwhile, investments in green hydrogen and battery storage technologies are gaining momentum.

- OPEC’s production decisions will play a pivotal role in determining oil price stability.

- Renewable energy projects are attracting record investments as governments aim for net-zero targets.

7. Geopolitical Factors

Geopolitical developments will significantly influence global markets in January 2025. Trade agreements, diplomatic relations, and regional conflicts are key areas to watch. The focus remains on how these factors affect supply chains, energy security, and investment flows.

- Europe: Ongoing negotiations around trade and energy policies post-Brexit.

- Asia-Pacific: Strengthened regional trade partnerships and focus on economic integration.

Conclusion

January 2025 is shaping up to be a dynamic month for global markets. With a mix of opportunities and challenges, businesses and investors must stay informed and agile. From sustainability to technological advancements and crypto markets, the trends outlined above will play a crucial role in setting the tone for the year ahead.