vdrsoftwareonline.com – XRP is both a cryptocurrency and a digital payment protocol created by the company Ripple Labs, designed to enable fast, low-cost cross-border payments. Since its inception, XRP has garnered significant attention due to its unique position in the cryptocurrency market, its technological innovations, and its involvement in high-profile legal disputes. In this article, we will explore the history, technological foundation, market performance, and ongoing legal challenges surrounding XRP.

1. What is XRP?

XRP is the native digital asset of the Ripple network, a payment protocol that was developed by Ripple Labs (originally known as OpenCoin). Unlike Bitcoin or Ethereum, XRP is not mined but is instead created and issued by Ripple Labs. The coin serves several key purposes within the Ripple ecosystem, primarily functioning as a bridge currency for cross-border payments.

Key Features of XRP:

- Speed: XRP transactions settle in about 3-5 seconds, far faster than traditional payment methods or many cryptocurrencies like Bitcoin.

- Low Cost: Transaction fees on the XRP ledger are a fraction of a cent, making it an attractive option for global remittances.

- Scalability: XRP can handle up to 1,500 transactions per second (TPS), vastly outperforming Bitcoin (which can handle ~7 TPS) and Ethereum (about 30 TPS).

- Energy Efficiency: Unlike Bitcoin’s proof-of-work mechanism, XRP uses a consensus algorithm, which is far more energy-efficient.

2. The Ripple Network: How It Works

Ripple isn’t just about XRP coins; it’s a comprehensive network for financial institutions to transfer funds. The Ripple protocol uses a unique consensus algorithm instead of the traditional proof-of-work or proof-of-stake mechanisms used by Bitcoin and Ethereum. This consensus mechanism is employed by a decentralized network of independent validators who verify transactions.

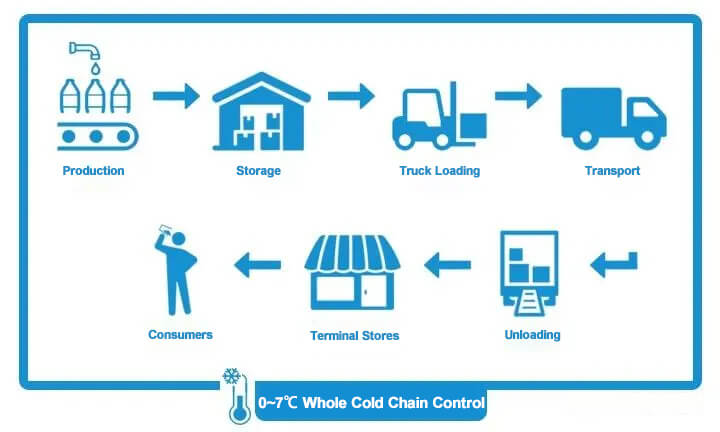

The Ripple network functions as a payment settlement, asset exchange, and remittance system, allowing for instant, secure, and low-cost transactions across borders. Ripple aims to connect disparate financial systems, banks, and other payment providers into a unified network that can facilitate seamless global payments.

- RippleNet: Ripple’s network is composed of financial institutions, banks, payment service providers, and digital asset exchanges, all of which use Ripple’s technology to facilitate international transactions. RippleNet is used by institutions to move money globally with more speed, efficiency, and transparency compared to traditional methods like SWIFT.

3. The Technology Behind XRP: Ripple’s Consensus Algorithm

XRP uses a unique consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA). The key feature of this protocol is that it does not rely on mining but instead on a consensus process among a group of independent validators. These validators agree on the validity of transactions, making XRP transactions extremely fast and energy-efficient compared to proof-of-work-based cryptocurrencies like Bitcoin.

The consensus algorithm operates in cycles of about 3-5 seconds, ensuring that transactions are confirmed almost instantly, which is a key advantage over other cryptocurrencies.

How It Works:

- Validators: A decentralized group of independent validators (trusted parties) maintain the integrity of the network by validating transactions and ensuring consensus.

- Ledger: The XRP Ledger is an open-source blockchain that records all transactions and provides transparency.

- No Mining: Ripple doesn’t use the energy-intensive mining process, so the network is more energy-efficient.

4. XRP and Its Role in the Cryptocurrency Market

XRP is often seen as different from many other cryptocurrencies due to its focus on institutional use and cross-border payments. While Bitcoin and Ethereum are designed to be decentralized and community-driven, XRP has been developed with partnerships in the banking and financial sectors in mind. As a result, XRP’s market behavior has often been less volatile compared to more speculative digital assets.

XRP’s Market Position:

- Market Capitalization: XRP has historically been one of the top 10 cryptocurrencies by market capitalization, competing with Bitcoin, Ethereum, and others for dominance in the global crypto space.

- Adoption by Financial Institutions: XRP has found adoption among a growing list of banks and financial institutions. Ripple’s enterprise solutions aim to streamline cross-border payments and reduce costs for banks and payment providers.

- Price Volatility: Like most cryptocurrencies, XRP has experienced significant price fluctuations. It saw its all-time high of over $3 in early 2018, but its value has since fluctuated in response to both market conditions and legal developments.

5. Legal Issues and the SEC Lawsuit

XRP’s journey has been significantly impacted by legal battles, most notably the Securities and Exchange Commission (SEC) lawsuit in the United States.

The SEC Lawsuit:

In December 2020, the U.S. SEC filed a lawsuit against Ripple Labs, alleging that the company conducted an unregistered securities offering by selling XRP as an unregistered security. The SEC argued that XRP should be classified as a security because it was sold by Ripple to investors as an investment contract.

Ripple, however, disagreed with the SEC’s stance, arguing that XRP is a digital currency and not a security. Ripple’s legal team contends that XRP has been used for years as a means of facilitating cross-border payments and is not intended as an investment vehicle like stocks or bonds.

Impact on XRP:

- Market Impact: The lawsuit caused significant volatility in the price of XRP, as many exchanges delisted the coin in response to the legal uncertainty. Some international exchanges continued to support XRP, however.

- Ripple’s Defense: Ripple has stated that the SEC’s case is based on an overbroad interpretation of the securities laws and that XRP’s utility as a payment protocol should exempt it from being classified as a security.

- Court Rulings: As of 2024, the case is ongoing, with various rulings and motions affecting the outcome. Ripple scored some wins in court, including the decision in July 2023 that deemed XRP not a security when sold to retail investors, but the fight is far from over.

6. XRP’s Future: Is It a Digital Currency for the Global Economy?

XRP’s future hinges on several factors:

- Legal Resolution: The ongoing SEC lawsuit remains a key factor in determining XRP’s status in the United States. A favorable outcome for Ripple could see XRP regain market confidence and potentially expand its usage.

- Adoption by Financial Institutions: Ripple continues to expand its network of banks and payment providers using XRP for cross-border payments. As the demand for faster, cheaper international payments grows, XRP’s use case could see even wider adoption.

- Regulatory Landscape: Global regulatory clarity on digital assets and cryptocurrencies will be crucial for XRP’s long-term success. Countries like Japan, Switzerland, and the United Arab Emirates have shown support for Ripple’s solutions, while others, like the U.S., have yet to establish clear regulations.

7. Conclusion

XRP is a unique cryptocurrency with a focus on improving the efficiency of cross-border payments. Its high-speed transactions, low fees, and scalability position it as a leading player in the blockchain-based payment space. However, its future is deeply intertwined with legal battles and the evolving regulatory landscape. The SEC lawsuit, in particular, continues to impact XRP’s price and adoption, with the resolution of the case likely to play a pivotal role in its future.

While XRP’s path has been far from smooth, its potential to revolutionize the global payments industry remains significant. If Ripple continues to expand its enterprise adoption and navigates legal challenges successfully, XRP could become a cornerstone of the digital payment ecosystem, serving as a bridge currency for cross-border payments in the digital age.

This overview should give you a solid understanding of what XRP is, how it works, and the challenges it faces as it continues to evolve. Let me know if you’d like more details on any specific aspect!